The MENA region is also experiencing a surge in digital payments, including those facilitated by NFC, that’s why financial institutions will be a target of cybercriminal and fraudulent activity. The dark web is a complex, multifaceted entity—both a repository of illicit opportunities and a mirror reflecting our society’s growing reliance on digital transactions. While the notion of stolen credit cards trading hands in underground markets is unnerving, it’s also a call to action. It empowers you to take control of your personal security and make better financial choices.

To avoid such losses, it is crucial to regularly monitor credit card transactions, report any unauthorized charges promptly, and take proactive steps to protect personal information. It is crucial to approach the Dark Web with caution and fully understand the risks involved. It is illegal and unethical to engage in activities that exploit stolen credit card information.

Curious About How Breachsense Can Help Your Organization Detect Credit Card Fraud? Book A Demo To Learn More

Once obtained, this information is then sold on underground platforms, making it accessible to criminals worldwide. Alongside the obvious sensitive data pertaining to the cards, the dump includes personal information as well, including email addresses, phone numbers, and the address of the card holder. As for the credit cards, the file itself features cards with an expiry date from 2023 to 2026. Internet criminals buy and sell personal data on the dark web to commit fraud. Here’s a breakdown of what your personal details might go for on underground marketplaces, according to the Dark Web Price Index by Privacy Affairs. NFC technologysignificantly enhances loyalty programs for businesses and consumers.NFC enables contactless transactions, allowing customers to earn andredeem loyalty points quickly and conveniently.

By monitoring the dark web, you can quickly identify when your cards are compromised through partner organizations or merchants. Network segmentation is absolutely critical for businesses handling card data. One particularly interesting detection method involves monitoring dark web markets themselves. Financial institutions tighten their security measures to prevent fraud but that also prevents legitimate transactions as a result. They invest massive resources into fraud detection systems, customer service teams dedicated to handling compromised cards, and the logistical nightmare of card reissuance.

Buyers use these cards to make unauthorized transactions, often attempting to maintain anonymity through the use of cryptocurrencies. Experian is a globally recognized financial leader, committed to being a Big Financial Friend—empowering millions to take control of their finances through expert guidance and innovative tools. As a trusted platform for money management, credit education, and identity protection, our mission is to bring Financial Power to All™. Prices can vary based on demand, how complete the data is and how easily it can be monetized by criminals.

Using Virtual Payment Cards

For many, it sounds like the plot of a spy thriller, but behind the drama lies a real risk for unsuspecting cardholders. The cybersecurity firm says the infostealer malware known as Redline was the most prevalent of the data-thieving malware, accounting for 34% of the total infections in 2024. Risepro, which primarily focuses on stealing banking card details and passwords, is another fast-spreading infostealer.

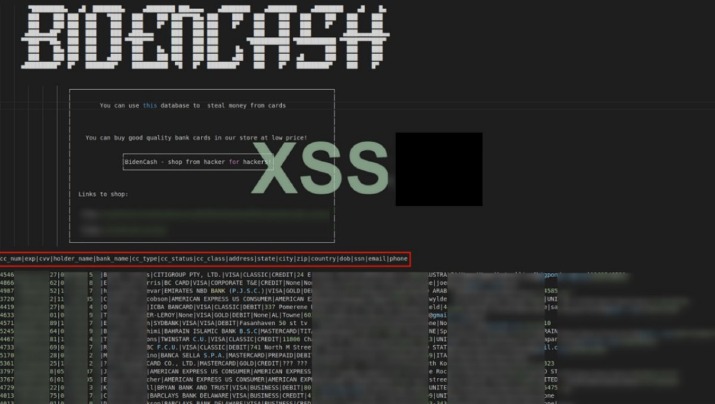

- As reported by Bleeping Computer, in an effort to attract cybercriminals to its platform, the hackers behind ‘BidenCash’ have distributed the details of 1,221,551 credit cards.

- Early detection enables your security team to prevent a transaction, minimizing the risk of a chargeback.

- By regularly checking your credit reports and statements, you can quickly identify any unauthorized charges or suspicious activity.

- The Dark Web, a hidden part of the internet accessible only through specialized software, is a hub for illegal transactions, including the buying and selling of credit cards.

Darkweb Market BidenCash Gives Away 12 Million Credit Cards For Free

Now that we understand why individuals are enticed to buy credit cards on the Dark Web, let us explore the risks and challenges involved in these transactions and how to navigate this treacherous landscape. The Dark Web, often mistakenly referred to as the Deep Web, is a clandestine part of the internet that is not indexed by traditional search engines like Google or Bing. It exists on encrypted networks, such as Tor (The Onion Router), which offer users anonymity and protection from surveillance. Carding websites continue to find creative ways to promote themselves on legitimate platforms—including global services like Last.fm (music streaming), Gravatar (avatar creation), and Pinterest (visual discovery). This misuse allows cyber criminals to reach a broader audience while evading detection—blending into the digital spaces that consumers and businesses use every day. Most of use just have the standard personal account, but Premier and Business accounts also exist, and are up for sale on the dark web.

But having your personal information exposed on the dark web can make it easier for others to access and use your identity. These stolen cards have value because they can be used to purchase high-value items or gift cards, which can then be resold for cash. These cards have a security chip installed, providing better protection than those with just a magnetic stripe. Since European countries have quickly adopted the EMV trend, the theft cases and percentages are lesser than in the US.

A 2019 data leak of another shop, BriansClub — which appears to have been by a competitor, according to Threatpost —shows how pervasive this trend has become. All content provided on Web Design Booth is for informational purposes only and does not constitute professional advice. We strive for accuracy and authority, but it is recommended to consult with qualified professionals before making decisions based on our content. Web Design Booth may receive compensation from third-party advertisers, which does not influence our editorial content. Abraham Lebsack is a seasoned writer with a keen interest in finance and insurance. Credit card prices also vary depending on the brand, with American Express being worth the most at 5.13 cents per dollar.

Regularly Updating Security Measures

Card Shops are a type of dark web marketplace that hosts the trade of credit cards and other stolen financial information. These platforms serve as hubs for cybercriminals to easily buy and sell compromised payment card details, including credit card numbers, CVV codes, expiry dates, and cardholder information. Credit card skimmers are designed to look exactly like card readers so that people aren’t suspicious of them. When a victim falls for a card skimmer and inserts or swipes their card, their card gets scanned and the card information is sent to the threat actor through Bluetooth. The victim’s transaction still goes through normally, so they won’t even know their card has been skimmed until it’s too late. Depending on the type of account a cybercriminal compromises, they can gain access to many types of personal information, including your credit card information.

Million Devices Hit By Infostealers—Bank Cards Leaked To Dark Web

See how we’re dedicated to helping protect you, your accounts and your loved ones from financial abuse. Also, learn about the common tricks scammers are using to help you stay one step ahead of them. If you see unauthorized charges or believe your account was compromised contact us right away to report fraud. The average cost of one stolen credit card’s information is US $17.36, with about $0.0033 per dollar of the credit limit. The price of a physical or cloned credit card goes up to $171, with $0.0575 per dollar of the credit limit.

Kaspersky: 98% Of Cybersecurity Experts Seek Improvements To Maximize Protection

Credit card details can be sold as digital items on the dark web, with the basics costing around $17.36. Physical cards, on the other hand, are cloned from stolen online details and can be used to withdraw cash from ATMs. A second major leak of cards relating to Indian banks has been detected by Group-IB, with over 1.3 million credit and debit card records being uploaded to the Joker’s Stash marketplace. Stolen credit cards are used to cash them out or make purchases that can be resold.

- Cybercriminals infiltrated their system, extracting thousands of customer credit card details.

- Once obtained, this information is then sold on underground platforms, making it accessible to criminals worldwide.

- Card checkers are tools used by threat actors to verify the validity and authenticity of credit card information they purchase on the dark web.

- Established in 2022, WizardShop is one of the biggest data stores on the dark web, focusing mainly on carding and financial data.

- Now that we have explored how to find Dark Web marketplaces, the next step is to learn how to select a reliable vendor for credit card transactions.

- The dark web is a complex, multifaceted entity—both a repository of illicit opportunities and a mirror reflecting our society’s growing reliance on digital transactions.

Comparitech researchers sifted through several illicit marketplaces on the dark web to find out how much our private information is worth. The release of this data poses significant risks for financial institutions and individual cardholders alike. The price for cloned cards varies depending on the credit limit, with an average price of $171. The three suspects from Indonesia confessed to stealing payment card data using the GetBilling JS-sniffer family. Carders target sites without these protections, and some vendors even sell lists of “cardable” sites for a few dollars.

What Should I Do If I Suspect My Credit Card Has Been Compromised?

To use these devices, threat actors attach them to actual card readers like the ones used in ATMs and at gas stations. It is important to highlight that participating in credit card transactions on the Dark Web is illegal and unethical. Engaging in illegal activities carries severe legal consequences and can harm individuals and financial institutions. This section is solely for informational purposes, and it is strongly advised to refrain from engaging in any illicit activities. They offer scalable healthcare services that push patients towards their health and wellness goals while supporting providers’ roles to achieve those milestones. The threat actors claim that at least 27% are still active, but it is unclear if that is true.

How To Protect Yourself

To pull off these credit card scams, D2 and other fraudsters would sign onto sites on the dark web and simply pay a small fee—as little as $35 — for victims’ credit card information. Sometimes hackers will commit “card-present fraud” by breaching the point of the sale at a physical store. Or they’ll commit “card-not-present fraud,” by hacking a website and stealing the online card information that gets entered into the checkout page.